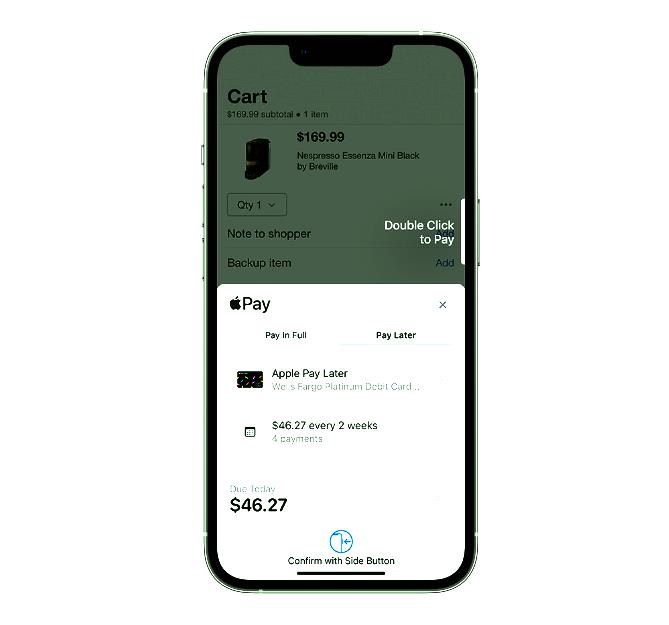

Apple’s “Apple Pay Later” service, which will allow iOS users to pay in installments using an option in the Wallet app. Now, according to Bloomberg, Apple will deal with the loan independently, without a partner bank.

Specifically, the company will use its subsidiary Apple Financing LLC to conduct credit checks and credit decisions for the new service, as this subsidiary has all the necessary licenses to provide certain banking services. Until now, all financial services provided by Apple, such as Apple Card and Apple Cash, were managed by third-party banks such as Goldman Sachs.

For Apple, this is a big step away from other partners with their own services. Earlier this year, Bloomberg already reported on Apple’s “Breakout” project, which aims to integrate the entire payment processing and financial infrastructure.

Of course, Apple’s partners such as Goldman Sachs and Mastercard will continue to play a “small role” in the new Apple Pay Later program, as Apple doesn’t have a bank card, the report said.

In 2019, Apple began offering interest-free installments for Apple Cardholders who purchase a new iPhone. The offer was later extended to other products, but is still limited to the Apple Store and Apple Card. With Apple Pay Later, any Apple Pay user in the United States will be able to pay in installments at any store.

The company is also reportedly developing its own fraud, billing and interest analysis system. With around $200 billion in cash and huge quarterly profits, Apple is certainly one of the few companies in the world that has the resources to provide its own financial services.